florida estate tax filing requirements

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The Florida Homestead Exemption provides multiple savings.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

. The types of taxes a deceased taxpayers estate can owe. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. You pay no property tax including school district taxes on the first 25000 of your homes value.

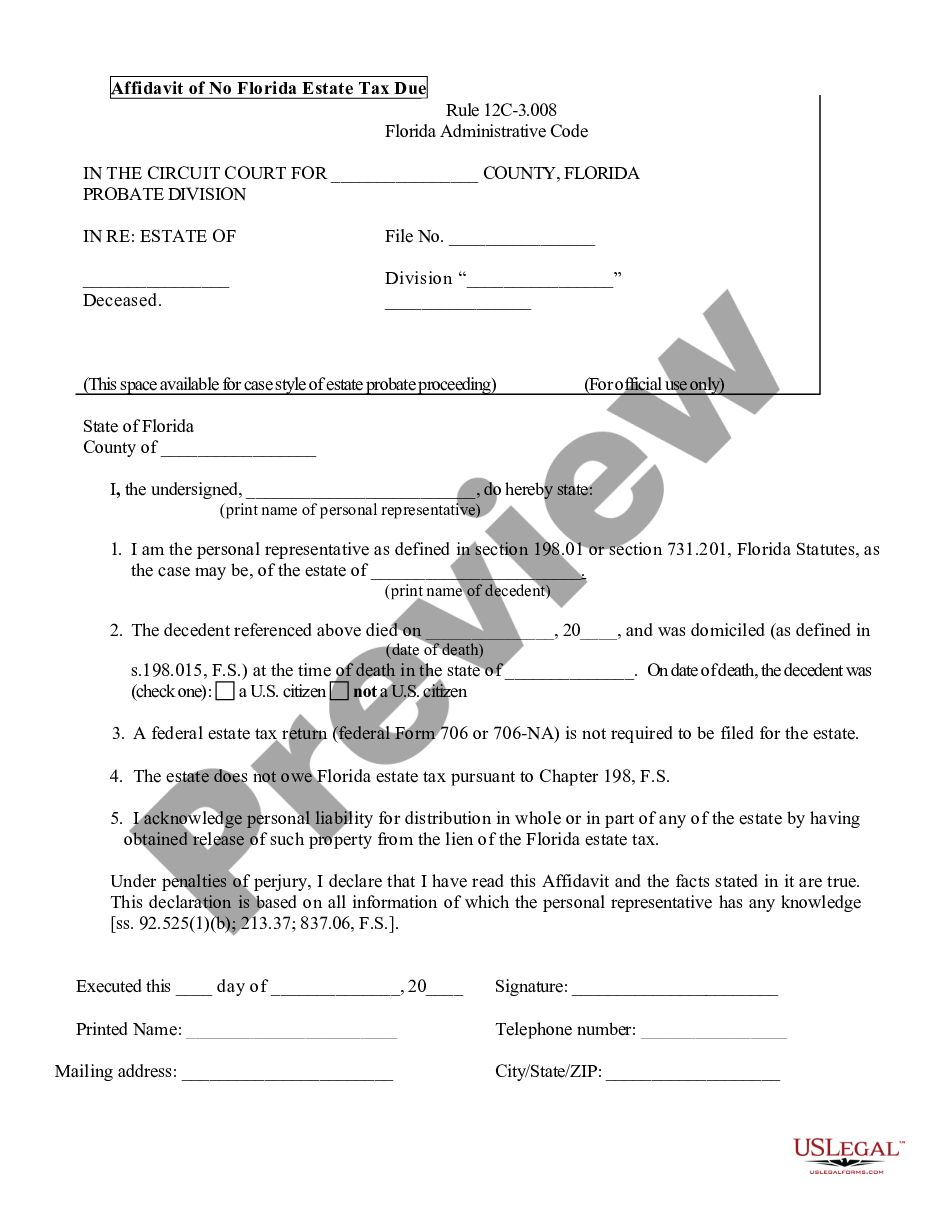

Application for a Florida Certificate of Forwarding Agent Address. Florida does not have an inheritance tax so Floridas inheritance tax rate is. When estate tax is not due because there is no federal estate tax filing requirement you.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. If the death occurs on or after January 1 2000 but before January 1 2005 the personal representative must comply with the two requirements listed above and. If they owned property in another state that state might have a different.

Floridas general state sales tax rate is 6 with the following exceptions. In Florida theres no state-level death tax or inheritance tax but there is still a federal estate tax requirement so if an estate is valued at more than 11 million there is a potential federal. Standard deductions in 2023.

PDF 220KB Fillable PDF 220KB DR-1FA. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. All foreign surplus lines insurers are required to file quarterly policy information to FSLSO for policy transactions written during the quarter no later than 90 days after the quarter ends.

2 Best answer. Florida estate tax due. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine.

Additionally counties are able to levy local taxes on top of the state. If the estate produces income or reaches the threshold to activate federal estate taxes the personal representative may have to file taxes on behalf of. File Taxes When Required.

While Florida does not have an income tax for trust trusts must file the Tangible Personal Property Tax Return. Similarly homeowners earning more than. Estate tax is not due if a federal estate tax return Form 706 or 706-NA is not required to be filed.

Also the standard deduction will increase in 2023 by 900 to 13850 for single filer or married but filing separately by 1400 to 20800 for head. As a result of recent tax law changes only those who die in 2019 with. Eligible homeowners with an annual income of 150000 or less will get 1500 in the form of property tax rebate checks from New Jersey.

Florida is one of 38 states that does not. February 2 2020 230 PM. Be sure to file the following.

There is no Florida estate tax. No Florida estate tax is due for decedents who died on or after January 1 2005. In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st.

Application for Consolidated Sales and Use Tax Filing Number. If you live in the state of Florida or have assets in the state of Florida I have some good news for you. You are a new Florida corporation and your tax preparer filed Florida Tentative IncomeFranchise Tax Return and Application for Extension of Time to File Return Form F.

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person.

The Ins And Outs Of The Florida Estate Tax The Florida Bar

Florida Property Taxes Mls Campus

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Notice Of Federal Estate Tax Return Due P 3 0950 Pdf Fpdf Doc Docx

Free Florida Small Estate Affidavit Pdf Eforms

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

12 Steps To Establishing A Florida Domicile Leech Tishman Legal Services

Affidavit Of No Florida Estate Tax Due

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Form F 706 Fillable Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens R 10 13

16 States You Don T Want To Die In Florida Estate Planning Lawyer Blog January 23 2009

Florida Gift Tax All You Need To Know Smartasset

Federal And Florida Estate Tax Considerations For Probate Zoecklein Law P A

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

Florida Estate Tax Rules On Estate Inheritance Taxes

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com